Choosing the business models that work for digital therapeutics

Access to healthcare still hinges on where patients live. For example, in the United States, roughly 81% of counties have at least one healthcare desert, according to a 2025 GoodRx study. This explains the rise of digital therapeutics (DTx). As software products, they emerged in response to this gap by supporting treatment beyond traditional care settings.

Studies show that DTx reaches about 80% adherence. Traditional pharmacotherapy stays closer to 50%. Turning clinical results into a sustainable business is a separate challenge. This article explains seven digital therapeutics business models and how to approach commercialization in real-world settings.

Why Business Models Matter in DTx

A DTx product is unlike any other medical software: it must undergo clinical validation in accordance with applicable regulations. Yet, securing regulatory approval doesn’t equal market success.

Take Pear Therapeutics as an example. In 2017, it secured FDA approval for its mobile app for substance abuse recovery, reSET. Notably, that was the first time the FDA approved a digital therapeutics device. And yet, in 2023, Pear Technologies declared Chapter 11 bankruptcy, auctioning off its assets for $6 million.

Business model challenges were among the key causes of Pear Therapeutics’ bankruptcy. The most pressing ones were:

- Reimbursement gaps

- Provider workflow integration challenges

- Patient engagement and adherence challenges

This is a cautionary tale for healthcare startups. Its message: approach digital therapeutics commercialization decisions carefully, lest you want to suffer a similar fate.

In practice, this means considering the following factors before fleshing out the revenue model:

- Regulatory environment: Existing regulatory framework (e.g., Germany’s Digital Healthcare Act (DVG) that legalizes prescriptions for Digital Health Applications), including marketing rules established by regulators (e.g., the FDA in the U.S.)

- Reimbursement policies: Existing digital therapeutics reimbursement framework for patients

- Partner ecosystem maturity: Ease of securing diverse digital health ecosystem partnerships with care providers, pharmaceutical companies, employers, and payers

- Patient adoption behavior: Adherence and engagement, which is typically driven by perceived usefulness and perceived ease of use, according to a 2023 study

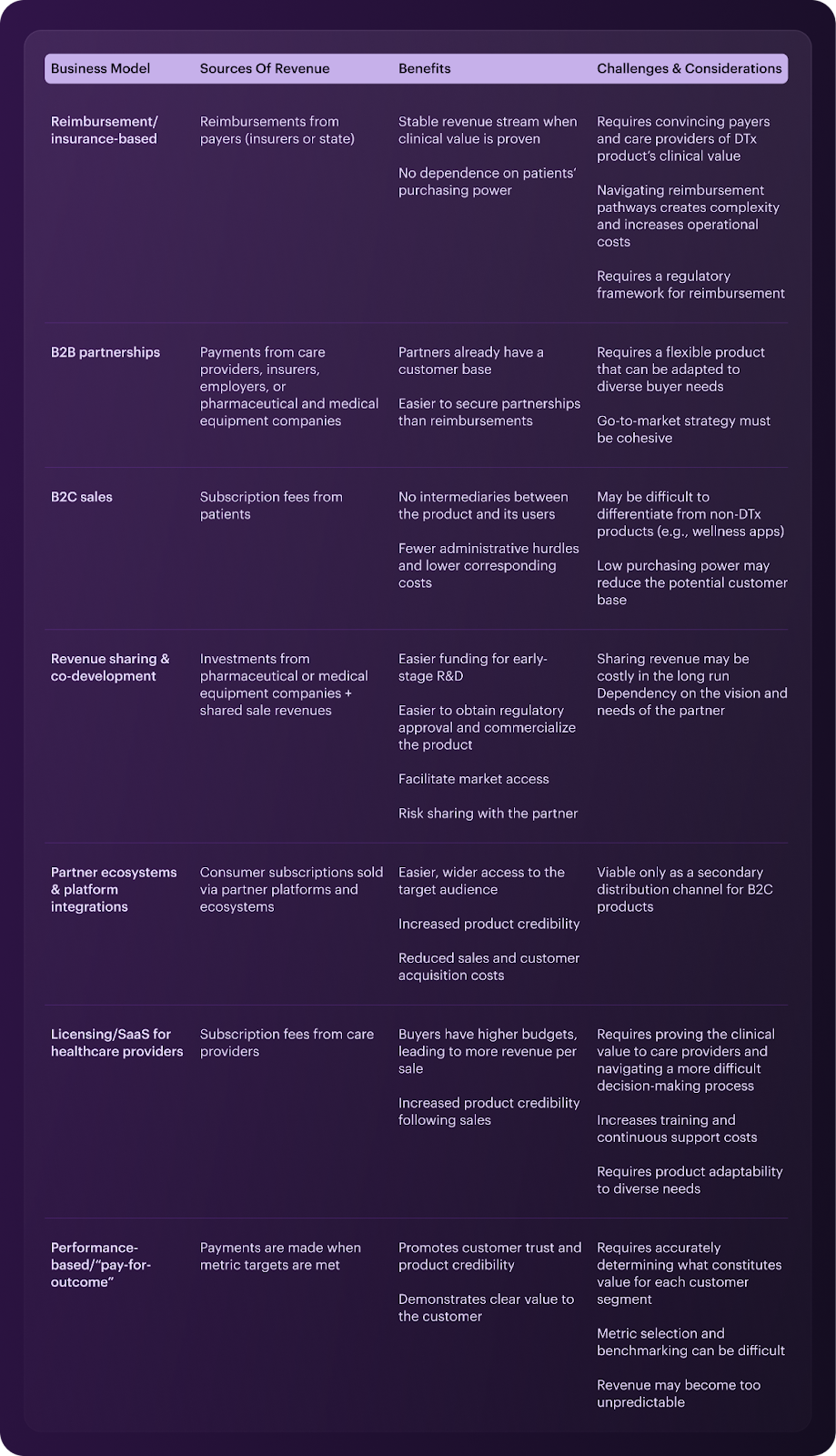

7 Main Digital Therapeutics Business Models to Know

About five to ten years ago, digital therapeutics companies primarily focused on reimbursements as a revenue source. For example, Pear Therapeutics was one of such companies.

Mahana and Akili also initially chose this model, though they later pivoted from it. Akili merged with Virtual Therapeutics and markets its game-based ADHD treatment for children directly to consumers. Mahana Therapeutics was recently acquired by Nerva and also pivoted to targeting patients living with IBS directly in its marketing.

Focusing on prescriptions and reimbursements, or on selling DTx products over the counter, aren’t the only two options available, however. These are the seven DTx business models that can help HealthTech startups generate revenue.

1. Reimbursement & Insurance-Based Models

Also known as the prescription digital therapeutics (PDTx) model, it’s based on the traditional monetization approach for pharmaceutical products. We can sum it up as:

- Securing regulatory approval (e.g., from the FDA in the U.S.)

- Promoting the product to care providers and patients to drive prescriptions

- Generating revenue in the form of reimbursements, either from the state (e.g., Germany) or the insurer (e.g., U.S.)

This model is suitable only for markets where regulations enable digital therapeutics reimbursement.

In multi-payer healthcare systems (e.g., the United States), however, the legal possibility of reimbursement isn’t enough. Digital therapeutics insurance coverage also plays a role. If most health plans don’t cover a DTx product, reimbursements will be a weak source of revenue.

Furthermore, this business model comes with two considerable challenges:

- Convincing payers that the product has clinical value and, therefore, warrants reimbursement

- Encouraging prescriptions through raising awareness among care providers and demonstrating value for patients

2. B2B Partnerships

Instead of relying solely on reimbursement as their primary source of revenue, healthcare startups can also pursue B2B partnerships. Under those partnerships, clinics, insurers, employers, and pharmaceutical or medical equipment companies buy the product to offer it to their patients.

For example, pharmaceutical companies can offer DTx products to patients or healthcare providers, bundling them with their own products. Case in point from Germany: Eli Lilly partnered with Sidekick to offer a DTx solution for breast cancer patients treated with Lilly's oncology drugs.

B2B digital therapeutics solutions are expected to capture the largest share of the industry’s revenue. Benefits are evident: business partners already have a potential user base and available capital to invest.

However, to successfully adopt it, the product’s adaptability to diverse buyer needs is a must. A cohesive go-to-market strategy can also be more difficult to flesh out than expected.

3. B2C Sales

If the reimbursement model is akin to commercialization for prescription drugs, the B2C models effectively rely on “over-the-counter” purchases. In other words, the DTx product is advertised directly to the patient, without intermediaries standing in the way.

Note: B2C digital therapeutics apps could theoretically be distributed in exchange for a one-time payment. That said, most companies opt for a subscription-based revenue model.

Reducing reliance on the go-betweens can be beneficial. However, the need to pay out of pocket may cut out patients with low purchasing power. Differentiating from other HealthTech solutions that aren’t clinically approved (e.g., wellness apps) can also be challenging.

4. Revenue Sharing & Co-Development

While it might resemble the B2B partnership model, the two digital therapeutics revenue models are far from the same. This model involves a much more hands-on partnership, usually negotiated with pharmaceutical or medical equipment companies.

In this case, the partner invests in development, has a say in the product strategy, and, of course, helps secure regulatory approval and commercialize it. The partner’s IP may also be used during development. In return, the partner gets a share of the revenue from the developed DTx product, as per the initial agreement. Partners also share risks inherent to dabbling in healthcare innovation.

Such digital therapeutics partnerships can appeal to startups in early stages of development. Co-development and revenue sharing reduce R&D costs and facilitate market access. Having an established company’s name attached to the project also bolsters its reputation.

5. Partner Ecosystems & Platform Integrations

Within any given market, partner ecosystems bring together businesses that target the same customer segments yet don’t directly compete with each other. In healthcare, these businesses include connected care and telehealth platforms and other digital health companies.

Note: Integrating the digital therapeutic products into the partner offerings typically serves as an additional distribution channel for B2C products. Direct subscription sales remain the primary monetization method.

Partner ecosystems facilitate access to target customers and may encourage sales with exclusive deals. They can lend credibility to the product and reduce sales and acquisition costs. Certain partner ecosystems also enable resource and expertise sharing.

6. Digital Therapeutics Licensing (SaaS for Healthcare Providers)

We’ve already covered the direct-to-consumer DTx SaaS model, but it’s not the only type of SaaS in healthcare. Digital therapeutics products can also be licensed directly to care providers in exchange for a subscription fee. (Once again, perpetual licensing is becoming a thing of the past as an unsustainable revenue model for software solutions overall.)

This approach shares a key challenge with the reimbursement model: the need to demonstrate clinical value. In addition, guidance for care providers who adopt the product is crucial. DTx businesses have to facilitate the adoption with training and continuous support. That, of course, requires an additional investment.

7. Performance-Based Models (“Pay-for-Outcome”)

Similar to the pay-for-performance healthcare model for care providers, this business model ties payment to metric-driven outcomes. Payments are based on the value provided; buyers pay only when the product meets specific targets. Those targets can reflect patient engagement and adherence and positive health outcomes, for example.

Implementing this business model requires a careful assessment of what constitutes value for the target customer. Care providers may value adherence to treatment or patient data availability. Payers and employers, in turn, will likely prioritize engagement and patient satisfaction.

In addition to that, selecting the right metrics to measure that value is crucial. Targets also have to be realistic enough to generate revenue.

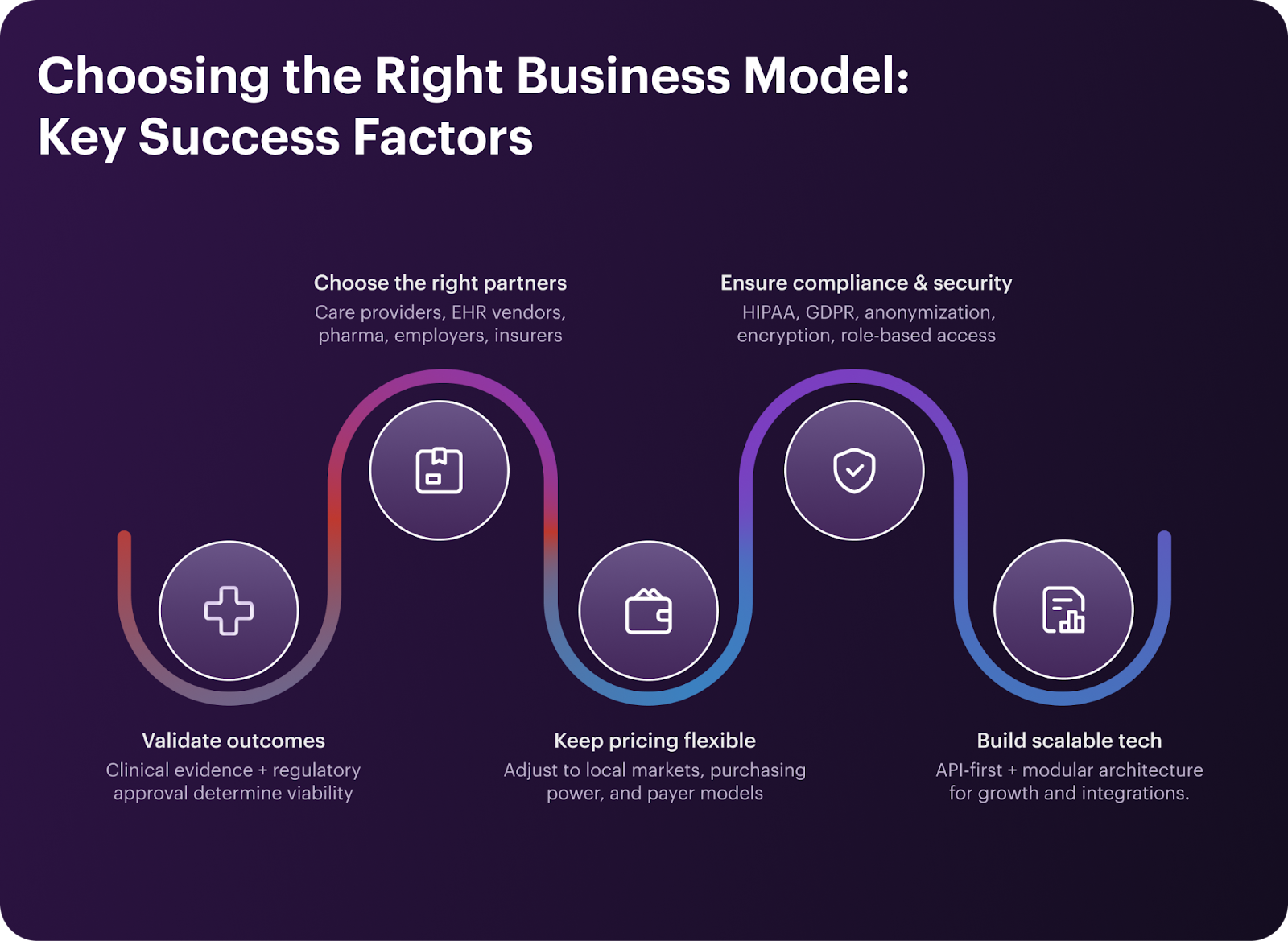

Choosing the Right Business Model: Key Success Factors

When it comes to digital therapeutics business models, there’s no one-size-fits-all solution. For example, companion digital therapeutics apps are well-positioned to sell B2C subscriptions. Brain scanning software that requires specialized hardware, in turn, calls for a licensing approach.

When we help HealthTech companies choose or revise their business models, we advise focusing on:

- Validating outcomes first. Without clinical evidence and regulatory clearance, no model will work.

- Finding the right partners. Care providers and EHR system vendors could be open to a mutually beneficial partnership. Other partners can include pharma and medical equipment companies, employers, and insurers.

- Maintaining pricing flexibility. You may need to adjust pricing to local markets, consumers’ purchasing power, and payer readiness. If you’re envisioning expansion to other countries, differences between healthcare payer models may also require revising the pricing model.

- Ensuring compliance and data security. One scandal can upend both valuable partnerships and consumer trust. So, adhere to both healthcare-specific (HIPAA) and universal (GDPR) privacy laws. Protect data with security best practices (anonymization, encryption, role-based access with the least privilege principle).

- Building a scalable tech infrastructure. An API-first architecture will facilitate integrations with partner platforms or systems. A modular architecture will, in turn, enable high performance as the product’s user base grows.

Note: Your business model doesn’t have to be an either-or choice. You can and should consider hybrid business models in digital health that combine multiple revenue streams. For example, a digital companion app can sell B2C subscriptions and generate revenue from enterprise deals.

Case Snapshots: How Leading DTx Companies Monetize

While we can learn from the failures of companies like Pear Therapeutics, the successes of leading DTx companies can also teach a few lessons. Here’s how four DTx leaders monetize their products:

- Kaia Health. Kaia Health sells its digital musculoskeletal pain management solution both directly to consumers (B2C subscriptions) and employers (B2B partnerships). Employer deals add Kaia Health to the list of employee benefits.

- Propeller Health. Propeller Health, the DTx company behind a respiratory disease management platform, was effectively a ResMed company. We use the past tense because ResMed, a San Diego medical equipment company, subsumed the startup, retaining the brand, IP, and assets. Propeller bet on a partnership with this established company, with data monetization serving as an extra revenue stream.

- Twill (formerly Happify Health). The company behind Happify, a digital therapy mobile app, opted for the B2B partnership model. (Note that DarioHealth acquired Twill in 2024.) Twill focuses on selling its app to employers, payers, and pharmaceutical companies.

- Voluntis. One of the leading chronic disease management apps, Voluntis, went all in on a co-development partnership with Aptar Pharma. In 2021, Voluntis was acquired by the pharmaceutical company and became part of its Aptar Digital Health division.

Key Takeaways

The days of a singular universal digital therapeutics business model are long gone — that is, if they were even there in the first place. The challenges of operating in an emerging industry mean you have to be flexible and sometimes creative to find the right revenue streams. To diversify risks, opt for a hybrid model with primary and secondary sources of revenue.

No matter the business model, validating clinical value is the glue that holds the product’s credibility together. So, focus on DTx clinical validation and regulation before selecting the revenue model. Secure partnerships early on, too: they have also proven to be effective as primary or secondary sources of revenue.

DTx products are no longer just apps or novelty tools. They’re already on the way to becoming an inherent part of the therapeutic infrastructure. Leverage this favorable climate by putting clinical value front and center to payers and care providers.

Not certain which sources of revenue should constitute your DTx product’s business model? Darly Solutions doesn’t just build solutions for HealthTech businesses; we also provide end-to-end support in launching and monetizing them. Book a call with our experts to discuss your digital therapeutics commercialization challenges.

FAQ

Insurance companies can approve or deny reimbursement for prescriptions of DTx products, provided the regulatory framework allows for it. They can also purchase DTx products to add them to the available health plans.

They can, depending on the digital therapeutics solution in question. The rationale generally boils down to either a competitive advantage in the labor market (as an extra employee benefit) or investment into employee productivity. For example, Twill promotes its digital mental health products to employers by highlighting that better employee well-being leads to significant ROI and cost savings.

Digital therapeutics solutions collect significant amounts of health data for specific conditions. This data, with proper metatags, can be sold as a real-world evidence (RWE) product. This product can inform further clinical research and product development at pharmaceutical or medical equipment companies. However, the data needs to be properly anonymized to protect patient privacy in line with applicable regulations (e.g., HIPAA). Plus, obtaining enough quality data for monetization is a long-term endeavor. That’s why, according to BCG, no DTx companies use it as a primary revenue source.

Yes, there are many hybrid business models in digital health as companies attempt to diversify their revenue streams and mitigate risks. For example, businesses like Kaia Health sell their products directly to consumers while also promoting them to employers, payers, or pharmaceutical and medical equipment companies.

Connect with us

.webp)

We are a tech partner that delivers ingenious digital solutions, engineering and vertical services for industry leaders powered by vetted talents.

.png)

.webp)